ABOUT THE BORGI

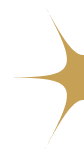

BORGI is an application that allows users to explore the principles of the three-dimensional economy⁶ in practice without financial or material risks. It serves as a financial tool in the Narmony System² simulation game, providing access to borgels³ and managing financial opportunities within the simulation of a new economic reality.

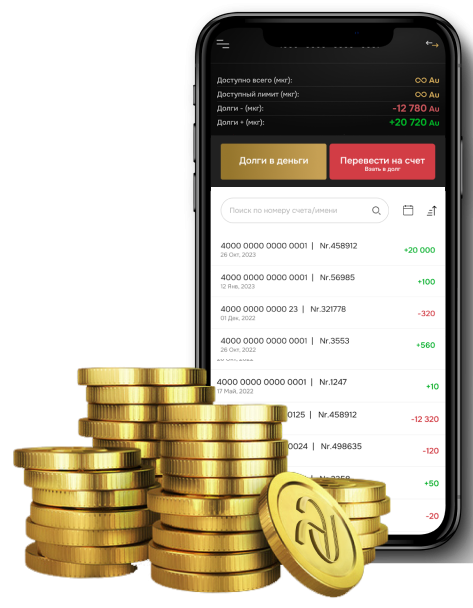

In BORGI, you can create borgels³ for transactions involving goods and services¹⁰.

Convert term borgels⁴ into perpetual borgels⁵ (create money within the system).

Explore the new system risk-free while learning the principles of an economy without inflation, crises, or financial limitations.

The BORGI app is not just a simulation but a practical demonstration of how one can live in a new economic reality rather than merely survive in an outdated one.

Join those who are shaping the future today.

Together, we will change the world for the better!

Money Without Inflation

Economy Without Crises

Unlimited financial opportunities

ABOUT THE APP

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et

quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores

eos qui ratione voluptatem sequi nesciunt. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam.

ABOUT THE APP

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et

quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores

eos qui ratione voluptatem sequi nesciunt. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam.

ABOUT THE APP

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et

quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores

eos qui ratione voluptatem sequi nesciunt. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam.

BORGI is an application that allows users to test the principles of three-dimensional economy⁶ in practice without financial or material risks. It serves as a financial tool in the Narmony System² game-simulation, providing users with access to borgels³ and managing their financial opportunities within the simulation of a new economic reality.

lorem ipsum

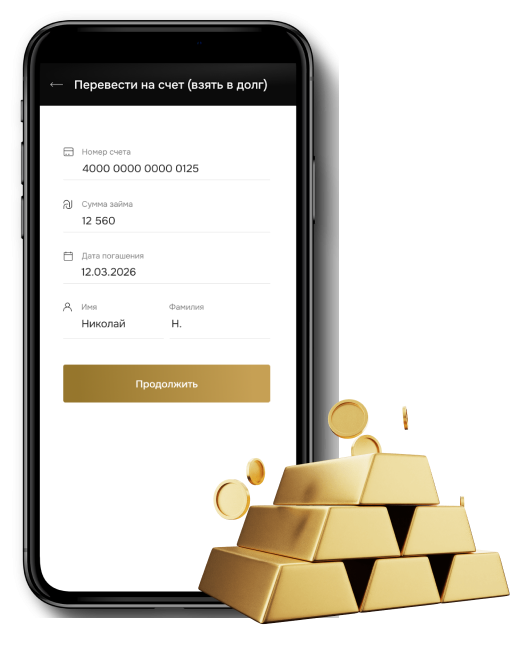

Borgels³ are a universal financial instrument that combines the properties of money, promissory notes, debt acknowledgments, and gold—without inheriting their drawbacks. In the Narmony System², borgels³ serve as next-generation money that does not depreciate over time.

Borgels³ are divided into term⁴ and perpetual⁵ types, each playing its own role in the new economic reality.

Questions and Answers

We offer not just an app, but a tool for the evolution of your economic thinking. The BORGI mobile application is your portal to an absolutely new economic reality.

Lorem Ipsum is simply dummy

Learn how to start taking advantage of new financial opportunities.

Join those who are shaping the future today.

Together we will change the world for the better!

Together we will change the world for the better!

Together we will change the world for the better!

Together we will change the world for the better!

Together we will change the world for the better!

Together we will change the world for the better!